- + Lowest credit score criteria

- ? The application form techniques is going to be seemingly a lot of time

- ? No pre-acceptance available

Investing you reside scarcely an adverse decision. They sometimes increase your guarantee, and more will than simply maybe not, it will come back to 100% of investment made.

There is nonetheless such a thing just like the crappy loans when it concerns do it yourself. Generally, the rules will still be exactly like which have every other variety of borrowing from the bank. Yet ,, there are a few essential intervening products regarding do-it-yourself.

Form of Do it yourself Financing

Signature loans have little being qualified requirements, as loans wade. But that doesn’t mean they’re right for folk, as they are risky for lenders and you can risk is costly; there are many, a whole lot more positive, finance readily available for home improvement for many who fulfill their standards.

However, unsecured loans usually tend getting an informed financing for house update without guarantee. Along with people instances, is going to be very well appropriate.

Family Security Financing

If you’ve got a good amount of equity gathered on your house, you have access to it through a house collateral loan.

Simply speaking, family equity money allows you to borrow money shielded of the value of your property. However you is going to be mindful whenever borrowing from the bank up against your residence since the lenders may require that you offer your house to settle your debt if you’re unable to if not pay for it.

Plus they can be the top version of mortgage to have home improvement for people who have loads of security and you may worst credit.

Essentially, HELOCs work such as for instance a charge card – you will get good revolving borrowing you could access since you are interested and after that you create costs toward amount you play with as opposed to the complete matter your qualify for.

HUD Label step one Property Update Loan

Once the lion’s display of your own financing try covered from the state fund, it is way less regarding a threat getting lenders. Shorter chance setting finest mortgage terms and conditions for you.

Name We possessions money commonly an easy task to qualify for, and various loan providers can get various other criteria. However they is normally an informed home improvement loans for bad credit individuals.

You’ll find a listing of HUD-recognized loan providers towards the HUD website and acquire more details on the this kind of loan from a great HUD-approved guidance agencies on the county.

Cash-Aside Re-finance

Thus, for those who are obligated to pay $100,one hundred thousand on the home loan, you can make use of a cash-away re-finance to get a great $150,one hundred thousand financial and employ the extra $50,000 for renovations.

Zero-Notice Home improvement Funds

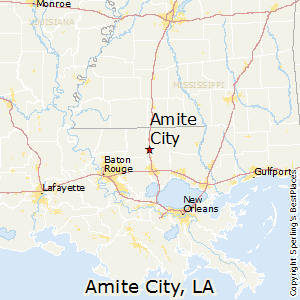

Depending on where you are, you will be capable get a minumum of one condition guidance applications to finance domestic renovations.

Title We funds is federally financed, but some counties and quicker county companies give customers direction situated on location and you will class. Inside exceptional instances, you may be eligible for a zero-interest financing and make disaster house repairs.

Several other preferred option is to search for handmade cards which have introductory 0% appeal offers. Particular provide no-attention episodes edd card balance as high as 1 . 5 years, and chain several like proposes to need extended and no focus.

Do-it-yourself Fund getting Pros

If you are a veteran in search of a personal loan, brand new USAA is best starting place. Brand new USAA’s rates are among the perfect for individuals with lower credit scores. And also the USAA has actually an exceptional overall satisfaction rating.

But not, there are many advice applications designed for veterans all around the country – one another from the federal and state accounts.

Ahead of investing a loan, contact the new Veterans Issues home loans solution. Their workers can help you find out if your be eligible for any assistance and just what best method is to try to financing the investment.

Recent Comments