The loan mortgage techniques concerns a variety of strategies and you may levels. This type of personal strategies flow the mortgage file submit which help you reach the finishing line, which is the last closure.

But along the way, you can find what exactly is known as a beneficial conditional approval out of your lending company. It indicates they want some much more information away from you, so you’re able to obvious your for closure.

Conditional Financial Acceptance Told me

Conditional approval: For the a home loan credit context, an effective conditional approval occurs when the mortgage underwriter is certainly caused by found towards the loan application file. But there are still no less than one issues that must getting resolved until the deal is personal.

So you may think of it since an eco-friendly light with an enthusiastic asterisk. The lending company features assessed the job and you can supporting data files, and you may total they like whatever they come across. Nonetheless you prefer some things checked out of ahead of they is issue a last recognition.

Underwriting: This is how the borrowed funds bank assesses your financial situation, creditworthiness, plus the assets you are to acquire to decide for individuals who qualify for that loan. It will help the financial institution determine whether or not to agree the mortgage, reject it, otherwise point an excellent conditional recognition requiring even more procedures.

During the underwriting, the financial institution ratings all facets like your earnings, property, expenses, credit history, a job reputation, plus the assessment of the home are ordered. This is accomplished to measure chance and also to ensure the financing fits people second standards regarding the FHA, Va, Freddie Mac computer, an such like.

Should your underwriter discovers that mortgage fits extremely standards however, has several outstanding affairs to handle, it’s called a conditional financial acceptance.

The way it Fits Toward Larger Procedure

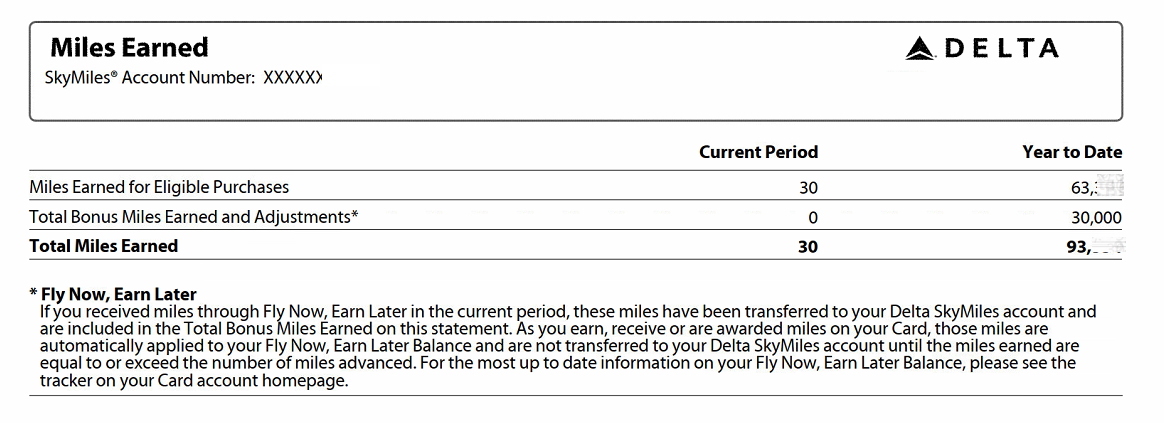

To place it to your a bigger framework, let us look at the simple steps one to take place inside the home loan techniques, including the conditional acceptance. While this process may differ a bit in one deal into the 2nd, they usually seems something like this.

Because this graphic suggests, property buyer exactly who receives an excellent conditional approval on the underwriting team (step 4) must eliminate those items before capable proceed to the fresh closing (step 6). Closing is when your sign every finalized a residential property and you may mortgage data files and you will close the offer.

Reasonable Instance of a great Conditional Recognition

John and you may Jane enjoys applied for a home loan, and you can they’ve given most of https://paydayloancalifornia.net/highland/ the data the bank has questioned to date. Its mortgage file then moves on on the underwriter, just who product reviews it to possess completeness and you can reliability. The guy plus monitors the brand new document to make certain the financing standards was satisfied.

This new underwriter find your individuals try eligible to that loan, and therefore the fresh new document includes what you needed to fulfill criteria. Which have you to different. A massive deposit was developed to your borrowers’ bank account inside the past couple of weeks, as well as the underwriter is unable to determine in which those funds emerged out-of.

So, the guy activities what numbers so you’re able to an excellent conditional acceptance with the financial financing. He pertains they returning to the borrowed funds manager or processor and claims the guy must know the source of the newest latest deposit. This will be an ailment in order to final acceptance. It product should be solved until the underwriter can also be point out that the borrowed funds is obvious to shut.

Now the ball has returned on the borrowers’ judge. They usually have basically already been considering a role to-do. To fulfill it consult, they must render a letter out of cause (LOX) that may go into the loan file.

If the John and you may Jane can completely file the cause of deposit – therefore looks like that currency originated in a prescription resource – the mortgage is going to be recognized. The final requirements were removed, additionally the few are now able to proceed to intimate into the home.

Recent Comments